Boards confront substantial change with increasing pressure coming from the company’s own shareholders. Fidelio’s Table Talk explores the source and mechanism of that pressure; we argue that Boards can turn shareholder revolt to advantage.

With the AGM season now in full swing, shareholders are being asked to vote on a variety of resolutions. Though full 2019 statistics will not be available for a while yet, it’s clear from previous years that the level of dissent will be significant and, in our view, unlikely to decrease as investors become less compliant than ever before. The recent 55% vote of no confidence in Bayer’s Management Board following the company’s acquisition of Monsanto represents an extreme case: most votes against Board resolutions do not achieve a majority, and their status is in most cases advisory rather legally binding.

Nonetheless, a negative vote is an important mechanism for investors to provide feedback on the Board’s performance, and Boards do well both to assess the implications of votes where there is a significant dissenting minority, and to address the issues raised. In the UK they are obliged by the Corporate Governance Code to record the measures they have taken in response to such votes, and in Fidelio’s experience, the Board can achieve considerably more working with investors rather than against them.

The 20% Dissent Level

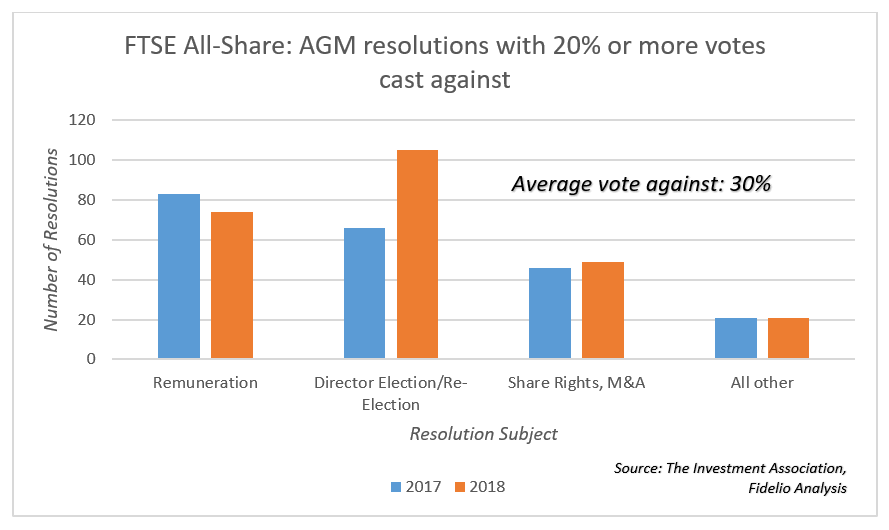

Following the UK Government’s 2017 package of corporate governance reforms, the Investment Association performs a valuable service by analysing company AGM resolutions and posting the data on the Public Register on its website. It records all resolutions where dissenting votes exceed 20% of those cast. This is something of an arbitrary boundary that came out of the Government consultation document, but it is now enshrined in the UK Corporate Governance Code and can be taken to mean that a significant minority of the voting shareholders disagree with the resolution.

In fact, in 2017 and 2018 in cases where the dissenting voice exceeded 20%, the average vote against was approximately 30%. Proxy advisory services clearly play a role here, since in cases where investment managers have delegated their voting to a proxy service, they will tend to act as a form of block vote on a particular issue. Challenging the proxy advisory recommendation can be a major challenge for a Board, particularly one lacking insight into the institutional markets and shareholder engagement.

The Issues: Remuneration and Director Independence Dominate

Though the 2019 dataset is not yet complete, the data from 2017 and 2018 shown above provide some clear conclusions. Consistent with Fidelio’s recent work on the subject, remuneration remains a hot topic, whether remuneration policy, the remuneration report or employee share schemes. In 2018 the number of contentious votes on remuneration fell somewhat from 83 to 73 but it remains a highly emotive subject, and one which has led to CEO and Chair resignations.

By contrast, the number of contentious votes on the election or re-election of Directors rose sharply in 2018 from 66 to 105. Many of these relate to Directors whose re-election does not conform with Code requirements on tenure and thus independence, and with increasing focus on enforcement of the “9 Year Rule” for Chairs as well, we expect this to remain a significant issue.

The remaining topics are something of a mixed bag, with items relating to share issuance and pre-emption rights as well as other M&A related issues accounting for 49 votes in the next category. The final “other” catch-all includes political donations as well as auditor appointment and remuneration: this last seems likely to remain controversial given that the topic of audit quality, including audit firm conflicts of interest, remains a lively one.

Boards, Change and Dissent

This snapshot of voting in UK listed companies sets very clear objectives for Boards and has implications internationally. A sharp focus on remuneration is required as the salience of this topic is likely to increase, with public sensitivity to inequality stoked by the media and fuelled by a pervasive impression that senior business people are overpaid.

Similarly, compliance with requirements on Director tenure is no longer negotiable, and investors can be expected to take a harder line on this topic in future. The “9 Year Rule” for Chairs appears already to have particularly impacted female Chairs who are often internal appointments to the role. This unintended consequence throws into clear relief the importance of increasing the pipeline of qualified diverse candidates for future Chair and Board roles.

Pre-empting Revolt

Shareholder revolts seldom come out of the blue. There is much that Boards can be doing pre-emptively to ensure that angry shareholders do not become a problem, and it’s key that both the Executive team and the Board are pro-active in pursuing a regular programme of engagement with investors. At the executive level this typically includes a CEO or CFO with a deep familiarity with the markets, as well as a highly capable IR Director who is respected by the markets and can speak truth to power. For a quoted company, Board composition and the skill matrix should also reflect the importance of understanding institutional investors, including their pressure points and lines in the sand. Dealing with difficult shareholder issues is always much easier if a relationship has been built and maintained in a systematic way.

Change is a given for Boards, and it’s increasingly driven by shareholders. Boards need to ensure they have the skills and experience at the Board table, as well as a highly effective executive to deal with the issues. If they don’t, the risk of inclusion on the Investment Association’s Public Register is high.

For more information on how Fidelio – through Search, Evaluation or Development – can support your Board in navigating change and unlocking value contact Gillian Karran-Cumberlege.